The world of finance is abounding with significant opportunities, and it only becomes tough to know how one differentiates trading from investing. It can be risky if you choose the wrong approach or miss other good opportunities.

The guide delineates the difference between trading and investing. We will cover the goals, time frames, and their associated analysis methods so that you can set a very clear course for your financial objectives.

Knowing the difference between trading and investing is going to help in making well-versed financial decisions. This will enable you to understand how to select the correct strategy that goes with your risk tolerance and your long-term goals.

The Difference Between Trading and Investing

Understanding Your Approach to the Market the world of finance can be perplexing, especially in regard to terminology. Terms like “investing” and “trading” are thrown around and used interchangeably, but there’s actually a pretty important difference between them. It is very important to know what these terms mean before an individual makes a decision in the market domain.

Basically, investing is the act of putting money into something that most likely will generate more money in the future. It’s a pretty long-term approach with its emphasis on gradual appreciation of assets. On the other side, trading is an investment activity involving the buying and selling of securities, taking advantage of short-term price movements.

Investor vs. Trader: Two Different Goals

Imagine two investors: Sarah, the investor, and Michael, the trader. Sarah buys shares in a company she believes has great growth prospects. She intends to hold on to these shares for a number of years while the value of the company—and hopefully the stock—grows. Michael is not so concerned about catching long-term market trends. He might buy and sell stocks in the same day, totally profiting on minor price swings.

In terms of time factor differentiators, investors generally hold their positions for long enough to be concerned about the long-term health of the underlying asset. Traders, on the other hand, frequently get in and out of positions to exploit the often short-lived market movements. Day traders, for example, buy and sell stocks within one trading day. Swing traders may hold positions for no longer than weeks or months.

Analysis: Intrinsic Value vs. Price Trends

Investors and traders also have varying styles of analysis. To estimate the intrinsic value—the true worth of a company—the investor goes to the core of a company. It is done based on the financial statements and such other factors as future growth prospects or the general state of the market. They intend to buy undervalued stocks so that, with time, as the price keeps going up, it mirrors the real worth of the underlying company.

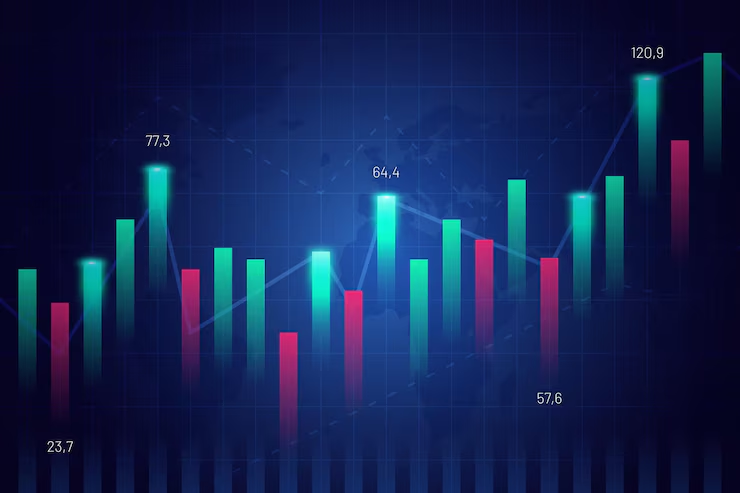

Traders do not usually have a major concern for the intrinsic value of a company. Their prime issues are technical indicators, including historical and chart data to measure trends and identify opportunities for buying or selling. The indicators may be complex and, to interpret them accurately, require considerable technical knowledge.

Risk versus Reward: Balancing the Equation

Both investing and trading involve some risk. That does not mean the risk profiles are similar. Overall, investing is much less risky, especially if you are working with diversified portfolios and a long-term perspective. There may be fluctuations in the market, but over time, it has had an upward trajectory. Trading, on the other hand, is much more dangerous due to the very short-term focus and the big possible losses if the market decides to go against your predictions. One of the attractions for traders is the opportunity to leverage their positions, since they can borrow money and rise their returns several fold. Naturally, potential losses are then also magnified.

The Allure and the Challenge of Trading

Probably influenced by films and books on this exciting, competitive environment of trading, many young investors are easily lured. Who would not be so? Short-term gains sound very alluring, from the very first thought. The thing is, again, that cases of success are usually not the rule but an exception. Trading requires much time, effort, and quite frequently, considerable capital. Most new traders find themselves at a significant disadvantage against professional traders equipped with forward-looking research and sophisticated algorithms.

The More Realistic, More Sustainable Approach: Investing

For most people, investing is more realistic and sustainable. If you do your homework, diversify the portfolio, and take a long-term perspective, the odds of success will be on your side.

Conclusion

In the final analysis, choosing between the path of investing or that of trading really boils down to personal objectives, risk tolerance, and financial means. Of the two, investing is probably better for long-term wealth creation. Then there is trading, if you are highly knowledgeable in technical analysis, can afford a high risk, and have the time to actively manage your portfolio. Keep in mind that with trading, success is never guaranteed, while investing is the practically possible route to financial security for most people.